Content

Someone capable of end-to-end accounting is going to cost a company more than someone less experienced in bookkeeping. Since 1997, Maria Christensen has written about business, history, food, culture and travel for diverse publications. She has created employee handbooks and business process manuals for small businesses, authored a guidebook to Seattle, and worked as an accountant in the construction, software and non-profit sectors. Christensen studied communications and accounting at the University of Washington, and history at Armstrong State University. The full charge bookkeeper will supervise these employees, helping to organize work flow and verifying accuracy of work. Some full charge bookkeepers in small companies wear many hats, working or supervising in areas such as purchasing, inventory and human resources.

What are bookkeepers charging?

You'll generally have one charge from $500-$2,500 that covers everything your business needs, with additional fees for overtime and other work added on top. To get an accurate quote for your specific small business needs, your best bet is to speak to a professional bookkeeper directly.

A skilled full charge bookkeeper efficiently handles all the accounting needs of the company, streamlining the business. The position is most commonly found in smaller organizations where there is no need bookkeeping for a controller, and which has relatively uncomplicated accounting transactions. If the company grows to a larger size, supervision of the accounting function is likely to be shifted to a controller.

Full-Charge Bookkeeping Services Handles Tax Preparation

Small businesses are subject to more fraud such as payroll schemes, alteration of checks and theft of inventory than larger companies. Accurate and comprehensive bookkeeping is imperative to discover and stop these types of fraud. Most companies prefer full charge bookkeepers with a combination of education, experience in the field, and advanced accounting software training. Since full-charge bookkeepers act as accountant-controllers, they handle the full cycle of accounting duties or supervise clerks in basic processing tasks. If you enjoy working with numbers and are detail-oriented, full-charge bookkeeping could be a rewarding choice of career. Although the field of bookkeeping and company-based accounting is projected to decline, almost all of the decline is represented by entry-level clerk positions being reduced by automation and technology.

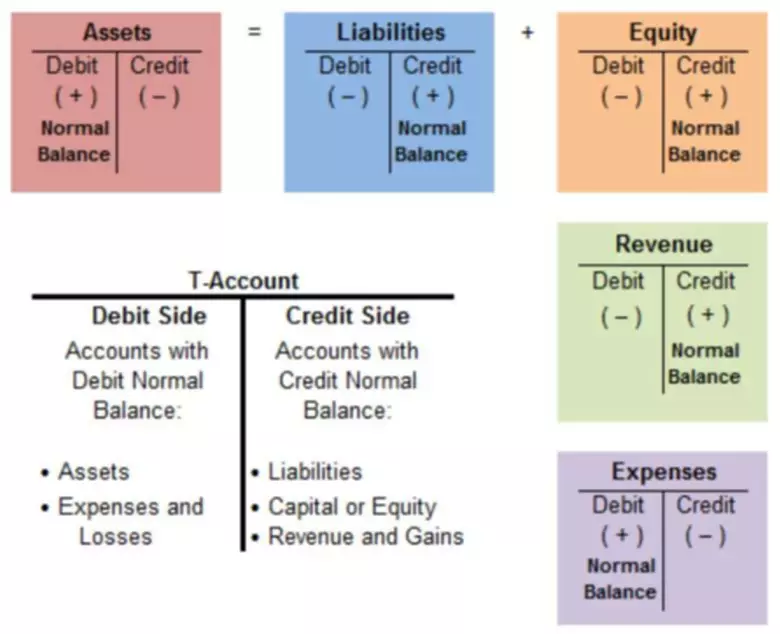

A freelance full charge bookkeeper can quote a fee that follows the industry standards, flexible, of course, based on the scope of the work. Tax laws are so complex that it can sometimes be difficult to file a simple return. Without having an experienced eye, it is easy to overlook deductions and credits. Computer software programs can not replace the expertise of a tax professional. Your balance sheet will include a formula for your assets, which equals total equity plus liabilities.

Get our agenda that we’ve used to build 6, 7, and 8 figure businesses.

Right off the bat, this bookkeeper starts their list of accomplishments in their most recent position with “spearheaded”. You can add strong action verbs like this – such as “oversaw” and “assembled” – to indicate to hiring managers that you have the ability to lead and manage a team of bookkeepers. Full-charge bookkeepers need to be self-starters who are able to multitask effectively. Strong communication, organizational and customer service skills are essential. Demands for technology expertise vary by company but may include proficiency with such applications as Microsoft Excel or QuickBooks. Businesses often seek candidates with at least five years’ experience, although expectations differ significantly by firm.

Most owners are not experienced in double-entry bookkeeping and lack the time to learn the ins and outs of payroll taxes, deposits, and tax reporting. In today’s fast-paced, data-driven business world, ensuring financial health and stability is paramount to a company’s success. At the core of this critical task lies the role of a Full Charge Bookkeeper, an indispensable professional who carries the crucial responsibility of managing an organization’s financial records and transactions. If you are looking for a reliable and affordable way to keep your books in order, you should consider using full-charge bookkeeping.

How to become a full charge bookkeeper

Not only will your FCB produce general financial statements, they can also generate reports for budgeting and financial forecasting, which creates an opportunity for growth. Many companies find outsourced bookkeeping solutions, like CFOshare, to be less disruptive to their existing staff. An outsourced hire can fill talent gaps while you decide if promoting within or hiring full-time in the future will continue to foster growth. Bookkeeping is typically entrusted to a junior and less experienced member of your business. Think of the standard bookkeeper like your basic car model, no bells and whistles but is functional and inexpensive. A full charge bookkeeper is that same make of car but with the upgraded package that includes heated and power seats, power windows and mirrors, and most importantly, comes with a higher price tag.

As the name suggests, a full-charge bookkeeper performs the bookkeeping duties for your business without you having to hire an accountant. They work in conjunction with a certified public accountant to prepare https://www.bookstime.com/articles/total-manufacturing-cost your company’s books. As a result, he or she will have access to the latest tax laws and legislation. You can also choose to have a full-charge bookkeeper perform payroll and tax-related tasks on your behalf.

Times

Typically, full charge bookkeepers prepare a company’s records for review by a certified public accountant. They may be in charge of accounts receivable, payable and payroll and tax deposits. They may or may not supervise clerks or assistants, depending on the size of the business.

What is full cycle bookkeeping?

What is Full Cycle Accounting and Bookkeeping? A full cycle accounting is a process of accounting activities that are followed by every business throughout the year, in the same repetitive manner, until the company remains in the business.

Recent Comments